- About Association

- Chairman’s Message

- The Association’s Objectives

- Resolution on the Establishment of the Association

- Governing Bodies

- Members

- National Depository Center

- Central Depository of Armenia

- Republican Central Securities Depository

- Georgian Central Securities Depository

- National Securities Depository Limited (NSDL)

- Central Depository Services (India) Limited (CDSL)

- Central Securities Depository

- Central Depository

- National Securities Depository

- National Settlement Depository

- Merkezi Kayit Kurulusu A.S. (MKK)

- Central Depository

- Central Securities Depository

- National Depository of Ukraine

- Korea Securities Depository

- Mongolian Central Securities Depository (MCSD)

- Central Securities Depository of Iran

- Information Materials

- Observers

- Contacts

Central Securities Depository of Iran

| Postal address | No. 68, East Sarv St. Tehran, 1997998583 IRAN |

| Tel. | +98 (21) 42 365 682 |

| Fax | +98 (21) 42 365 186 |

| intl@csdiran.ir | |

| Web-site | https://en.csdiran.ir |

To explore the legal framework of CSDI, please visit: https://en.csdiran.ir/pages?page=legal-environment-of-csdi.

Mohammad Baghestani

Chief Executive Officer & Board Member

In mid-November 2021, Mr. Mohammad Baghestani took the helm as Chief Executive Officer of the Central Securities Depository of Iran (CSDI), concurrently representing the Securities & Exchange Organization (SEO) on the Board of Directors.

Mr. Baghestani's executive credentials are firmly established, honed through past leadership roles on the Board of Directors at KarAfarin Bank’s brokerage firm and Pardis Investment Company, and most notably, by steering Tadbirgaran Farda Brokerage Firm as its CEO. This diverse range of experience across financial institutions grants him invaluable insights and expertise.

Mr. Baghestani's academic credentials include a Master's degree from Imam Sadiq University and a Ph.D. in Financial Management from Islamic Azad University, providing him with diverse and valuable expertise. This expertise plays a vital role in shaping the financial landscape under his leadership at CSDI."

The shares of CSDI mostly belong to Iran's capital market entities, commercial banks, investment institutions, financial groups, brokerage firms, and pension funds.

| SHAREHOLDER | NUMBER OF SHARES (MILLION) | PERCENTAGE |

|---|---|---|

| Capital Market Entities | 2.077 | 19/87% |

| Banks | 2.187 | 20/82% |

| Investment Companies | 2.244 | 21/36% |

| Financial Groups | 1.8 | 19% |

| Brokerage Firms | 1.072 | 10/2% |

| Others | 1.917 | 18/24% |

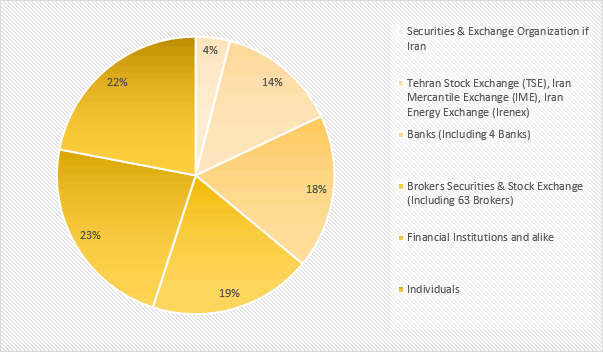

| Securities & Exchange Organization if Iran | 4% |

| Tehran Stock Exchange (TSE), Iran Mercantile Exchange (IME), Iran Energy Exchange (Irenex) | 14% |

| Banks (Including 4 Banks) | 18% |

| Brokers Securities & Stock Exchange (Including 63 Brokers) | 19% |

| Financial Institutions and alike | 23% |

| Individuals | 22% |

The structure of Central Securities Depository of Iran (CSDI) is detailed at:

Central Securities Depository of Iran engages in a variety of critical business functions, including:

- Account Management:

- Opening and maintaining security accounts for both individual and institutional investors, involved in Stock and commodity exchanges

- Securities Depository:

- Depositing various types of securities

- Record Registry and Transaction Handling:

- Ownership record keeping, transaction recording and maintenance, instrument specification management, data integrity assurance, clearing and settlement operations for securities, and other financial instruments listed on stock exchanges of Tehran Stock Exchange and Iran Fara Bourse

- Corporate Actions:

- Executing a range of corporate actions on behalf of issuing companies, encompassing dividend distribution, rights issues, bonus issues, mergers & acquisition, stock option grants, delisting, name changes, bankruptcy proceeding, and capital increase

- KYC and AML/CFT Compliance Administration

- Implementation of robust Know Your Customer (KYC) procedures and adherence to Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT) practices, fostering a secure and compliant environment within the securities depository

- Electronic Governance Solutions:

- Providing issuing companies with specialized services for hosting electronic general meetings and enabling secure electronic voting mechanisms, ensuring efficient and transparent corporate decision-making processes.

- Risk Management:

- providing comprehensive risk management services, with a focus on key areas including operational risk, settlement risk (establishment and management of a settlement guarantee fund), liquidity risk, credit risk, legal and regulatory risk, custody risk, technology and cybersecurity risk, systemic risk, and reputational risk.

- Reporting and Investor Services:

- Crafting and delivering customized reports tailored to the specific needs of diverse stakeholders

- Providing investors with access to their account information, including a detailed breakdown of their portfolio holdings, transaction history, corporate action information through CSD portal

- International Collaboration:

- Collaborating with regional and global CSDs, stock and commodity exchanges and related institutions

- Equity Transfer and Legal Execution Services:

- facilitating the transfer of inherited shares and managing the process of seizing shares in accordance with court orders

- Security Pledges:

- Depositing securities pledged by individuals and legal entities, ensuring beneficiary control, and facilitating redemption upon request.

- Open Market Operation (OMO) Support:

- Offering a complete array of services within the Open Market Operations (OMO) framework, covering the facilitation of securities transactions, immediate settlement of purchases and sales (T+0), secure administration of ownership records, collateral management, real-time information dissemination, effective settlement supervision, collaboration with market participants, and commitment to regulatory compliance.

- Justice Shares Solutions:

- Providing an all-encompassing suite of services for the Justice Shares scheme, including registry and depository functionalities, facilitation of securities transactions, settlement services, administration of ownership records, collateral management, real-time information dissemination, efficient settlement supervision, and rigorous adherence to regulatory requirements.

- Commodity Exchange Services:

- Extending a diverse range of services to the Iran Energy Exchange and Iran Mercantile Exchange, encompassing registry and depository functions for commodity holdings, facilitation of seamless securities transactions related to commodities, settlement services to ensure timely and secure completion of transactions, management of ownership records for transparent and accurate tracking, collateral management to support financial transactions involving commodities, real-time information provision for market participants, efficient oversight of settlement processes to minimize risks, collaboration with market participants to enhance operational efficiency, strict adherence to regulatory requirements governing commodity markets.

- Tax Administration Services:

- Offering a comprehensive suite of services for tax administration, including tax withholding and reporting, tax compliance services, information reporting, stamp duty, and tax treaties and compliance

- Financial Ability Certificate Services:

- Issuing and verifying Financial Ability Certificates electronically, customized to meet the specific requirements of stakeholders

- Warehouse Operations:

- Maintaining a registry of warehouse receipts and executing operations to facilitate transactions on commodity exchanges.

- Specialized Services:

- Providing specialized services to stock exchanges, commodity exchanges, securities issuers, financial institutions, and other market participants

CSDI consistently releases various publications, encompassing annual reports, newsletters, and bulletins of CSDI and Commodity Exchanges. These resources provide valuable insights into our operations, achievements, and industry developments. To access these publications, please visit https://en.csdiran.ir/pages?page=publications. Stay informed about CSDI's activities through our regularly updated publications.

Additionally, you can stay connected with us on our social media platforms.

Central Securities Depository of Iran (CSDI) actively engages in international cooperation, underscoring its pivotal role as the primary infrastructure provider in the Iranian capital market. This collaborative effort is directed towards several key objectives:

- Adherence to International Standards: CSDI collaborates in the development, implementation, and promotion of globally recognized standards for pre-trade, post-trade, registry, and maintenance. The aim is to safeguard investor interests, ensure the fairness, efficiency, and transparency of markets, and address systemic risks comprehensively.

- Investor Protection and Confidence: Through information exchange and cooperation, CSDI strives to enhance investor protection and instill confidence in the integrity of securities markets. This includes sharing experiences and best practices to fortify the regulatory framework and safeguard investors' interests.

- Global Information Exchange: CSDI actively participates in the exchange of information at both global and regional levels. By sharing experiences, it contributes to the development of markets and reinforces market infrastructure. This collaborative approach is crucial for staying abreast of international market trends and adopting best practices.

CSDI's commitment to international collaboration is further evident through its membership in global and regional institutions, serving as a conduit for the dissemination of technical expertise across diverse regions worldwide. More details about the organizations and institutions that CSDI is affiliated with can be found at https://en.csdiran.ir/pages?page=memberships.

Additionally, CSDI has formalized numerous Memoranda of Understanding (MoUs) with CSDs and capital market entities globally. These agreements, spanning various geographical regions, signify CSDI's dedication to nurturing strong relationships with counterparts beyond Iran. The purpose is to foster the exchange of knowledge and promote robust CSD and capital market infrastructure practices on an international scale. A comprehensive list of entities with whom CSDI has signed cooperation agreements can be accessed at https://en.csdiran.ir/pages?page=mou.